Marc Rosenblum, RSSA®, CFP®, ChFC®, CLU®, has nearly four decades of experience in investments, tax strategies, retirement planning, Social Security, life insurance strategies, estate planning, and long-term care insurance. He holds his life & health insurance license in Pennsylvania, as well as his Series 6, 7, 24, 63 and 65 securities registrations from FINRA. In addition to being the founder and CEO of American Cornerstone Group, Inc., he is an independent IAR, investment adviser representative, of Silver Oak Securities.

Founder & CEO

Marc Rosenblum, RSSA®, CFP®, ChFC®, CLU®

To expand his knowledge base for his clients, Marc has also obtained multiple financial services designations, including CERTIFIED FINANCIAL PLANNER®, CFP®. (To obtain a CFP® designation, a candidate must hold a bachelor’s degree or higher (in any discipline) from an accredited college or university, complete coursework on financial planning through a CFP Board Registered Program, pass the two-day exam which lasts for three hours each day, and complete either 6,000 hours of professional experience related to the financial planning process or 4,000 hours of apprenticeship experience that meets additional requirements.) He also holds his ChFC®, Chartered Financial Consultant, as well as his CLU®, Chartered Life Underwriter, designations.

As head of American Cornerstone Group, Marc doesn’t work alone, he has a large network he partners with to help clients. With skilled accountants, attorneys and analysts on his team, and always working in his clients’ best interests as a fiduciary, Marc has garnered a loyal and multigenerational clientele, many of whom he has worked with for decades. He can help you take the next important step toward realizing your financial goals, enjoying a worry-free retirement, and leaving a loving legacy for your family.

Despite holding multiple licenses, registrations, and designations, Marc is as easy-going and down-to-earth as anyone you would want to meet or work with. He’s a relatable guy who loves his family, loves people, and meets with people where they are—even at your favorite restaurant or coffee shop—to drop off documents or discuss an important matter. He frequently goes above and beyond what his career actually demands in order to support a client. He has even arranged a funeral for a client who was too emotionally fraught to handle it.

As a result, most of Marc’s clients become true friends, and he and his wife, Karen, often socialize with the families they’ve become close to.

Marc Rosenblum Shares Estate Planning Tips

Marc Rosenblum Talks Social Security

Marc’s Personal Story About Why and How He Became an Advisor

My journey into the financial advisory business and later specializing in wealth preservation and retirement planning began in my childhood.

Before my 6th birthday, my dad died. That was devastating, but worse was watching my mom struggle as she raised three young kids on a teacher’s salary. So, as a teenager, to earn my own money and ease some of my mom’s burdens, I mowed lawns and worked odd jobs, and in high school and college I sold hot dogs and beer at Phillies and Eagles games – what a gig for an avid sports fan! It was hard work, but I was okay with that. I accepted my circumstances, rolled up my sleeves, and went to work.

Watch Video: Get to Know Marc

Soon I started at Temple University in Philadelphia where I majored in business finance and marketing. That’s when I started my first job with a life insurance company. Times were different back then, and I went door-to-door selling policies. I met so many people, put together suitable policies for them, and remain friends with many to this day.

Later I worked for an independent life insurance agent, and that led to helping clients with investment and retirement plans. I needed to be licensed to do this, so I studied for and received all the licenses and certifications necessary to be a top financial advisor and planner.

Then I decided to take a risk and go out on my own because I’d become very skilled at strategically customizing plans and selecting the most appropriate products necessary to implement those plans. Also, with my mom, there was a need and, finally, an opportunity for me to help her manage her finances and plan for retirement. I wanted to bring my skills and experience to the community as well because it was clear that most people wanted to have a retirement nest egg but had little idea how to start or to make necessary adjustments as they grew older and as their life circumstances changed.

For example, most didn’t know how to reduce or even avoid paying taxes in retirement. Most didn’t know that Social Security and Medicare have avoidable “tax traps,” or that they should plan how and when to use taxable, tax-deferred, and tax-free asset buckets to manage their income and tax brackets efficiently. Most didn’t know that they could use certain life insurance policies to pay for their long-term care if they don’t have LTC insurance. I recognized a need and felt it important to help folks by sharing information and showing them how to act on it.

I had learned at a young age to listen attentively, and that made it easy for me to be a holistic planner: I take into account a client’s lifestyle and family, health status, financial situation and goals, desired retirement age, the legacy they want to leave, and so on, rather than just recommend products based on what clients think they need. I continue holistic planning to this day.

I soon began specializing in financial planning for people who are 5-10 years away from retirement and for those already retired. I started out with a few life insurance clients who soon became investment clients. They in turn referred me to others, and those new clients referred me, and on it went. I was really helping people, and my practice grew!

If you were to ask my clients why they are with me – and many have been for decades – they’d say it’s because I am consistently approachable, trustworthy, reliable, skilled and a great listener. Paying attention to what they tell me and how they answer my questions is incredibly important to holistic planning. My clients would also say that I’m hands-on with regular account reviews and check-in calls, and that I always advocate for their best interests as a fiduciary. I work in close partnership with my clients and develop lasting, multi-generational relationships that are built on trust and superior service. New clients can rest assured that these same principles and ethics apply to them as well.

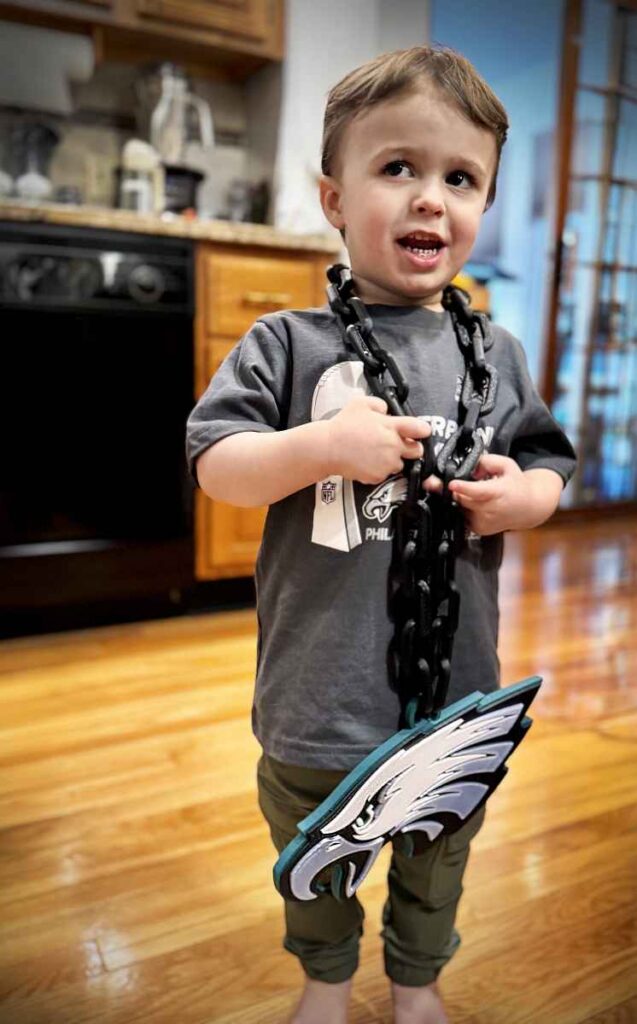

Besides working together, my wife Karen and I enjoy supporting our Philly teams, traveling, and visiting with our kids (and now grandkids!). In the summers we can be found at our favorite South Jersey beach. In the winters we are avid Flyers (season ticket holders) and Eagles fans.

Our top priority is always about helping you take care of yourself and your family.

We treat you like family at American Cornerstone Group. When you’re ready to have your questions and concerns addressed, or to be sure you really do have all your boxes checked, we’re here for you. Schedule a complimentary consultation to start planning for your short- and long-term financial goals today. Call us at (215) 672-7676 or schedule online.

- College planning? Check.

- Retirement planning? Check.

- Estate planning? Check.

- Investments? Check.

- IRAs, 401(k)s, Social Security planning? Check, check & check.

It’s All About You

Long-term relationships that encourage open and honest communication have been the cornerstone of our firm since its inception and the foundation for our success. We want to learn as much as possible about your personal situation, your dreams and goals, and your tolerance for risk. The first step toward your journey to financial stability is having written goals, then implementing a custom plan developed just for you and your family through the generations.

Independent | Fiduciary | Multiple Strategic Partners

Our firm is independent and unbiased, and we have access to a large universe of financial services and products. As fiduciaries, we are legally required to do what’s in your best interests at all times, and that’s exactly the way we want it. We work as a team with your own legal and accounting professionals, or we have a network of strategic partners, CPAs, analysts, and estate attorneys that we can bring to the table on your behalf.

Schedule a Complimentary Consultation

Educational Resources

Our website is filled with educational videos, articles, and whitepapers designed to help you learn more about many financial topics, especially important during volatile and turbulent times. Be sure to explore the site, bookmark, and check back regularly to see more! If you have any questions that come up, feel free to call or send us a message. We take our clients’ (and prospective clients’) questions and suggestions seriously as we continually strive to make financial planning more understandable for everyone.

Our top priority is always about helping you take care of yourself and your family.

Schedule your complimentary first meeting with us to discuss how we can help you attain your financial goals. Remember that goals without a plan to achieve them are just wishes!

Schedule an AppointmentAmerican Cornerstone Group, Inc.

12106 Centennial Station

(Bldg. 12, Professional Center)

Warminster, PA 18974

Office: (215) 672-7676

Fax: (215) 682-7676

© 2026 American Cornerstone Group. All Rights Reserved. Securities and investment advisory services offered through Silver Oak Securities, Inc., member FINRA / SIPC. American Cornerstone Group, Inc. and Silver Oak Securities, Inc. are not affiliated.

Privacy Policy | Form CRS | ADV Part 2B

Contact Us

Let’s spend 60 minutes on a call together to talk about your financial and retirement goals and what we might to do help you achieve them. Schedule a time, call us at (215) 672-7676 or send us a message here.